Homeowners Insurance in and around Woodland Park

Woodland Park, make sure your house has a strong foundation with coverage from State Farm.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

- WOODLAND PARK

- DIVIDE

- FLORISSANT

- LAKE GEORGE

- TARRYALL

- CASCADE

- GREEN MOUNTAIN FALLS

- COLORADO SPRINGS

- BROADMOOR

- MANITOU SPRINGS

- MONUMENT

- SEDALIA

- GUFFEY

- CANNON CITY

- CRIPPLE CREEK

- SALIDA

- HARTSEL

- FAIRPLAY / ALMA

- BUENA VISTA NATHROP

- LEADVILLE

- BLUE RIVER

- BRECKENRIDGE

- FRISCO

- VAIL

There’s No Place Like Home

Everyone knows having great home insurance is essential in case of a windstorm, blizzard or hailstorm. But homeowners insurance is about more than covering natural disaster damage. Another valuable component home insurance is its ability to protect you in certain legal situations. If someone is injured on your property, you could be required to pay for physical therapy or their hospital bills. With adequate home coverage, your insurance may cover those costs.

Woodland Park, make sure your house has a strong foundation with coverage from State Farm.

Help protect your home with the right insurance for you.

State Farm Can Cover Your Home, Too

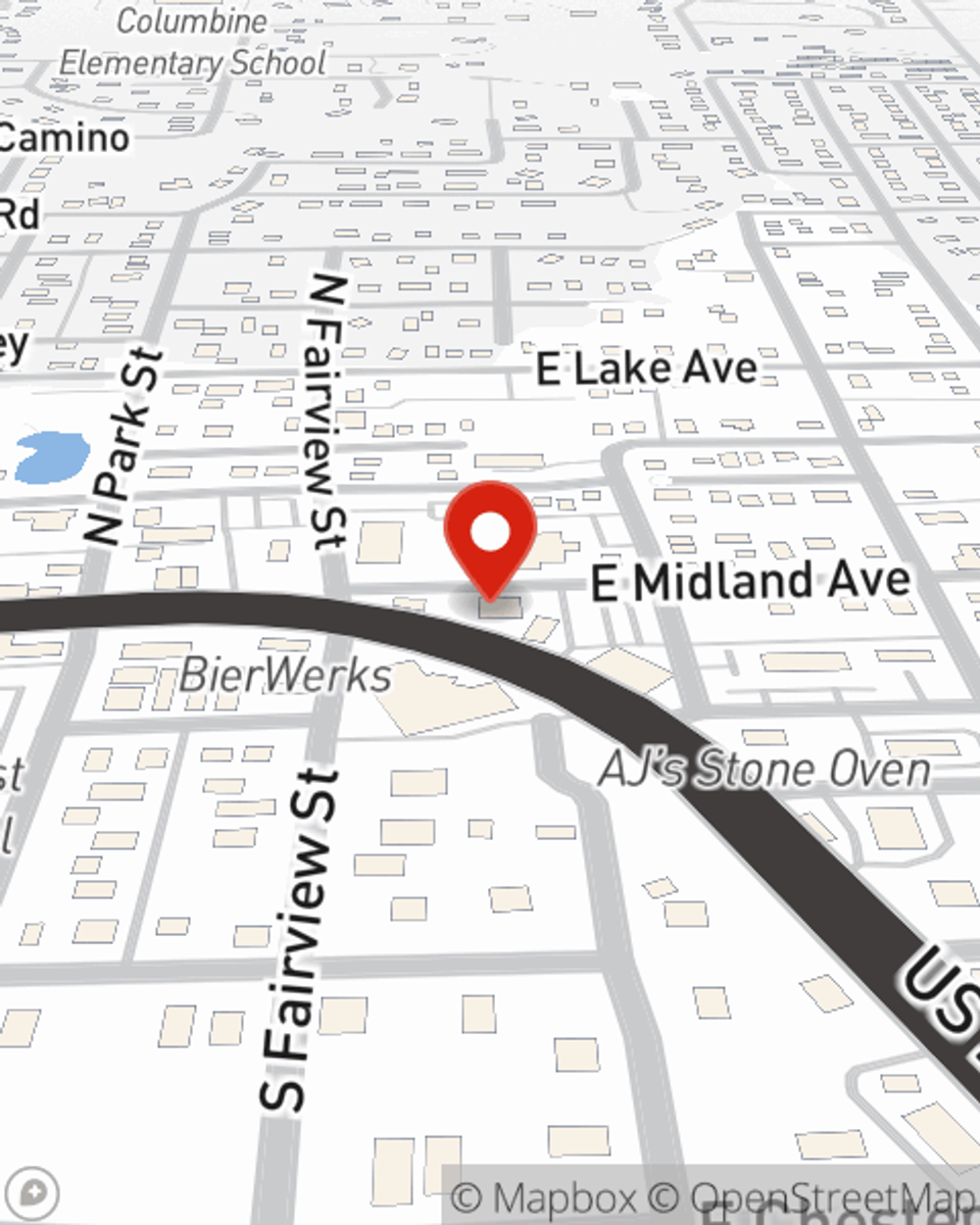

Protection for your home from State Farm is the way to go. Just ask your neighbors. And visit agent Erica Szymankowski for additional assistance with getting the policy information you need.

As a leading provider of home insurance in Woodland Park, CO, State Farm aims to keep your belongings protected. Call State Farm agent Erica Szymankowski today for help with all your homeowners insurance needs.

Have More Questions About Homeowners Insurance?

Call Erica at (719) 686-0046 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Roof maintenance tips for your home

Roof maintenance tips for your home

Your roof is put to the test daily. Learn how to recognize the first signs of a problem inside or outside your home and when to get a new roof.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Erica Szymankowski

State Farm® Insurance AgentSimple Insights®

Roof maintenance tips for your home

Roof maintenance tips for your home

Your roof is put to the test daily. Learn how to recognize the first signs of a problem inside or outside your home and when to get a new roof.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.