We are excited to welcome new agents to grow and develop our team! Increasing our team's capacity will allow us to better serve our community and respond to inquiries more efficiently and quickly! Please be patient as we train and develop this new talent and help us welcome our new crew to the family. See the Team Members section below to learn more about our licensed team.

WHAT WE DO...

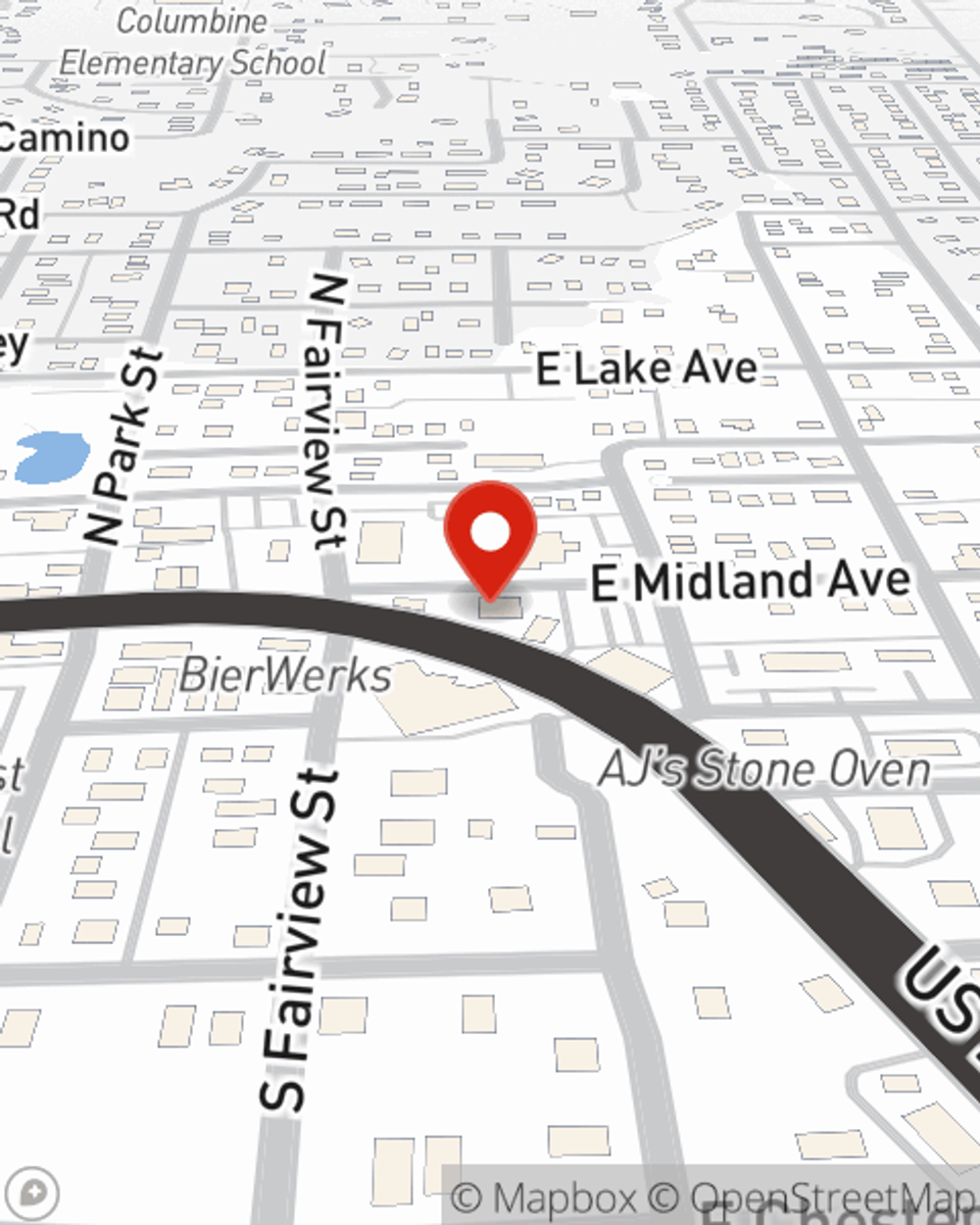

Rockin' Insurance Consulting for the Rocky Mountain Families and Business of Colorado! We speak insurance so you don't have to! If you are in a major accident, what do you want your insurance to do for you? Need help understanding the mumbo-jumbo on your auto insurance "DEC" page? Not sure which numbers and slashes to pick for Liability Coverage? Want to really understand what you are paying for and why? Schedule a complimentary consultation and come into our local office in Woodland Park and chat with us! Warning - our coffee is really good and you might want to stay for two cups!

We help small and medium sized businesses establish and maintain comprehensive business insurance and financial goals to keep their businesses growing securely. Whether you need Worker's Compensation Insurance, General Liability or Professional E&O (Errors and Omissions Insurance) we'll help you plan for the unexpected. Also ask us about helping you set up company benefits for your employees, like a Commercial Life Plan or Retirement options! We can even help you with growing, saving, investing, and lending for your business money.

We also consult with individuals and families of all ages, types, and sizes to help you understand and properly plan your homeowner's insurance, car insurance, life insurance, and even income, assets, debts, and health insurance. Need help with new home purchase financing or loan? Yup, we do that too!

Are you confident that your insurance will properly cover you in the event of a major at-fault incident?

Even if you are sued for millions or your family was no longer able to rely on your income? What if you get disabled and can't work? How do you want your insurance to support your family? Let's talk to consider what policies are right for you - before a loss occurs.

We identify gaps in coverage, explain concepts and encourage all of your questions - especially the silly ones - and consult with you to help you find the right plans for your needs.

OUR HISTORY AND FOUNDING...

Our agency started as a love story...Colorado College student, Erica, was an auto insurance internet lead for Agent Patrick Szymankowski in Colorado Springs. A few days after buying insurance, she crashed her car and the knight in shining armor came to the damsel's rescue! Fast forward a few years and Erica and Patrick teamed up to open the Szymankowski Insurance Agency in Woodland Park, Colorado. Growing strong since 2010, we are helping more people than ever imaged with all things insurance and money!

Over the years, the agency has grown tremendously and earned many high-level awards around the world, including State Farm Chairman Cir, Exotic Ambassador Travel, Senior Vice Presidents Council, and industry awards like The M.D.R.T. Our highly successful, friendly, and motivated team is always seeking a better way to help our customers, and we are committed to being the favorite agency in the territory. We insure all over Colorado, including, but not limited to, Teller County, Park County, Summit County, El Paso County, Douglas County, Custer County, Fremont County, Denver County, etc. We honor state to state re-locations and carry forward your tenure and loyalty discounts from your prior State Farm policies, when applicable.

ABOUT THE AGENT...

Erica Szymankowski, RICP is the President of Szymankowski Insurance Agency, Inc. and a State Farm Agent. She has a Bachelor's Degree from Colorado College in Romance Languages (French and Spanish) and Pre-Medicine. She holds multiple insurance and financial services licenses and designations and is a life-learner continuing her studies and advancing her degrees and designations constantly. She is a hard working Mamma of three awesome kiddos and proud wife of an Army Veteran, and she loves the outdoors and all Rocky Mountain Adventures.

Our philosophy includes some key points: 1. Choose the RIGHT thing to do, do it, and do it RIGHT. 2. Don't hesitate, but always wear your helmet. 3. "Surround yourself with great people and get out of the way." (- Ronald Reagan) 4. Take care of others, with the right intentions, and the rest will follow.

We hope you will be the next member of our insurance and financial services family. Please call or stop in today to see how we can help you, like no other agency can!

While we will attempt to accommodate walk-ins, Appointments are Highly Recommended. Please call to schedule an appointment with our professional team.

***COMMENTS ON HOMES IN THE WILDFIRE ZONES***

Risk must be accessible to emergency vehicles year round. *

There must be an access road to the risk from two different directions. The access roads and driveways must be paved or gravel road minimum width of about 25 feet and may not be in a state of damage or disrepair or have barriers that make it difficult or unsafe to drive on.* If you don't have two access roads, it's time to talk with your community/county/city officials about fixing that.

Structures must not be located more than 1⁄2 of a mile, off a two-way access road. This includes structures located on dead ends and cul-de-sacs. Private drives must be maintained year-round.*.

The address must be posted at the beginning of the driveway and clearly marked with light reflective material. Driveways must be able to accommodate emergency vehicles.

A minimum Hard Space around main structure and Defensible Space must be maintained, including from adjacent buildings.

Hard Space is defined as an area of at least 5 feet of non-combustible space around the base of all structures (including decks). Wooden fences must have a non-combustible fire barrier between the fence and structure (Non-combustible material within 5 feet of structure).*

Defensible Space is defined as an area of at least 30 feet free of flammable vegetation including grassland and brush, dead or dying plants, firewood, and unembedded stumps or logs. Surface litter (fallen leaves, twigs, pine needles, pinecones, and bark) should be reduced and living plants and trees should be trimmed of dead and dying branches and foliage.

Tree branches must not extend over the roof of any structure, be within 10 feet from the ground, and/or from chimneys/stovepipes.

Firewood and all other combustible materials must be stored at least 30 feet from the dwelling. If the structure is on a slope these items must be stored uphill from the structure.

Wooden Yard Structures: The presence of wooden yard structures (e.g. arbors, pergolas, trellises, playground equipment) should be considered in relationship to the overall exposure.

All dead trees within 50 feet of a structure must be removed (including beetle-kill trees).

Above ground fuel storage tanks (including propane and fuel oil) should maintain an area of 10 feet clear of debris and combustible materials around the tank.

An approved Class A (composition, tile, metal, concrete, clay) roof is required for all structures. Wood shake and shingle roofs are not acceptable. We highly recommend an Impact Resistant Class IV roof.

Open roof eaves on the exterior of the structure should be enclosed.

Roofs and gutters must be clear of debris.

Spark arrestors must be installed on all chimneys and stovepipes and be constructed of metal screening with openings not exceeding 1⁄4 inch.

Raised decks must be kept clear of accumulations of combustible materials.

These are just a few of the things we look for when considering insuring a home in the wildfire zones. You can do your part to improve the risk exposure to your home and our community by following and maintaining these guidelines. Homes that don't meet these requirements, may not be eligible for homeowner's insurance with us. We consider all applications individually based on full underwriting of the policy application. State Farm Underwriter's, not agents, make the final decision on whether to issue a policy.

If you are applying for a homeowner's policy with our office, please click on the "Contact Us" link above or below to upload your photos. Please include photos of all sides of the home and structures with enough background so we can see the landscaping. Be sure to include your full name and contact info so we can match your photos to your application.

Thank you!